The Strategic High Ground of Tech Giants

Global Tech Investment Weekly – Week 1 of November

TxT Investment Team

11/7/20253 min read

The Strategic High Ground of Tech Giants

TxT Insight: Anchoring Efficiency in the Physical World — Why AI Infrastructure Will Define the Next Decade’s Alpha Returns

Last week, we raised a critical question:

“Does this company truly hold an efficiency advantage in the physical world?”

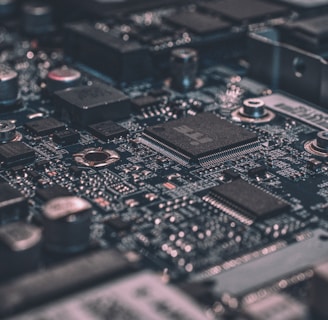

To answer it, we must start from the foundation – AI Infrastructure, the system that powers artificial intelligence in the physical world.

It includes:

Hardware: GPUs, CPUs, TPUs, large-scale servers, and high-speed network equipment.

Software: Machine learning frameworks, data processing tools, and automated deployment platforms.

Network and Storage: High-speed connectivity and scalable cloud or distributed file systems.

At this stage, physical infrastructure has become the ceiling of efficiency.

AI workloads demand unprecedented power density and system stability – traditional servers draw only 2–4 kW per rack, but AI racks now consume 50–80 kW, with total data center energy use expected to rise 165% by 2030.

Without breakthroughs in physical systems, computing expansion will hit real-world limits.

Two Key Frontiers Driving Physical Efficiency:

Cooling Systems

Traditional air cooling no longer meets performance needs. NVIDIA’s latest GB200 NVL72 system adopts full liquid cooling, while Schneider Electric, Vertiv, and LiquidStack are also betting on liquid-cooling innovations to enhance thermal efficiency.

Energy Systems

According to Hanwha’s research, AI data centers must shift from “high consumption” to “high efficiency” by integrating renewable energy sources like wind and solar, alongside storage and advanced cooling.

Google, through long-term Power Purchase Agreements (PPAs), has achieved 100% renewable energy for its global data centers and is now integrating local storage and microgrids for flexible load balancing.

In short – AI data centers are evolving from power-hungry giants into efficient, sustainable compute engines.

This Week’s Major Tech Investment Highlights

1. NVIDIA’s Valuation Soars to $5 Trillion: From Selling Chips to Building Global AI Infrastructure

At NVIDIA’s GTC conference in Washington, Jensen Huang declared:

“The data centers of the future won’t store files — they’ll manufacture intelligence.”

NVIDIA’s strategy now unites chips, networks, cooling, software, and factories in a single optimized design.

Highlights include:

GB200 + NVLink-72: Linking 72 GPUs into one “superchip” with 10× performance.

Omniverse DSX: Simulating factory layouts, cooling, and energy digitally before physical buildout.

BlueField-4 and Spectrum-X: Enabling high-speed GPU communication and eliminating bottlenecks.

Rubin Architecture: The next generation focused on doubling performance and cutting costs via co-optimization across chips, interconnects, and energy systems.

Recent moves:

Finland (Oct 28): Invested $1B in Nokia to co-develop AI + 5G/6G network infrastructure.

Korea (Oct 30): Delivered 260,000 Blackwell GPUs to Samsung, SK, and Hyundai for national computer, robotics, and automotive use.

Germany (Nov 4): Partnered with Deutsche Telekom (€1B) to build an “Industrial AI Cloud” in Munich.

India (Nov 5): Joined the India Deep Tech Alliance, backing an $850M emerging tech fund.

Ongoing Global Smart City Projects: Extending “Physical AI” systems to Dublin, Ho Chi Minh City, and Raleigh.

2. OpenAI Restructures; Microsoft Holds ~26–27% Equity

OpenAI completed its transition to a fully for-profit company, with Microsoft emerging as a strategic core shareholder.

TxT Analysis:

Clearer ownership: Microsoft now has formal equity alignment, deepening operational synergy.

Cloud–Model integration: Combining Azure cloud and OpenAI models builds a unified ecosystem.

Valuation shift: This dual “AI + Cloud” model could redefine the sector’s valuation standard — monetizing both compute and intelligence together.

In essence, OpenAI is no longer just a model company — it’s a platform where computers and intelligence are co-monetized.

3. Obesity Drug Race Escalates: Pfizer Wins $10B Bidding War for Metsera

As of November 8, Pfizer secured its $10B acquisition of obesity drug developer Metsera, defeating Novo Nordisk, which withdrew due to antitrust risks.

Metsera’s assets include monthly GLP-1 injections (regulating appetite and insulin) and Amylin-pathway therapies (enhancing satiety and metabolism).

The deal strengthens Pfizer’s pipeline in obesity and metabolic treatments.

TxT Insight:

Metabolic health is becoming the new global healthcare battlefield. McKinsey notes that GLP-1’s success is pushing healthcare toward integrated metabolic management. Whoever builds a holistic platform — combining clinical protocols and payment frameworks — will dominate chronic disease ecosystems.

Strategically, Pfizer is using acquisition to reenter the GLP-1 race after internal R&D setbacks, while Novo Nordisk leverages its first-mover approvals and ecosystem scale to maintain dominance.

Both are vying for the strategic nodes of the metabolic value chain — defining the next phase of biopharma leadership.

Conclusion: The Strategic High Ground Is Being Redrawn

From NVIDIA to Microsoft to Pfizer, global giants are escalating from product-level competition to system-level warfare.

NVIDIA is building computers–energy integrated “AI factories.”

Microsoft is binding cloud and intelligence into a single platform.

Pfizer is consolidating leadership across the metabolic healthcare ecosystem.

Across industries, the underlying logic is the same:

Whoever builds the platform, sets the standard, and controls the system’s evolution — owns the future’s strategic high ground.

For early-stage investors, the key is to identify who is entering, shaping, or owning the infrastructure and production chains that underpin this transformation.

And the next question is clear:

Where will the next strategic high ground emerge?

Energy? Compute orchestration?

Or perhaps, in an unseen corner of the physical world?

Stay tuned for next week’s exclusive insights.